Asset Returns

several definitions

Let Pt be the price of an asset at t, the one-period simple return is defined as:

Rt = (Pt−Pt-1)/Pt-1

and the one-period gross return is Pt/Pt-1 = Rt+1.

The holding period for an investment may be more than one unit. For any integer k ≥ 1, the k-period simple return is:

Rt(k) = (Pt−Pt-k)/Pt-k

and the k-period gross return is Pt/Pk-1 = Rt(k)+1

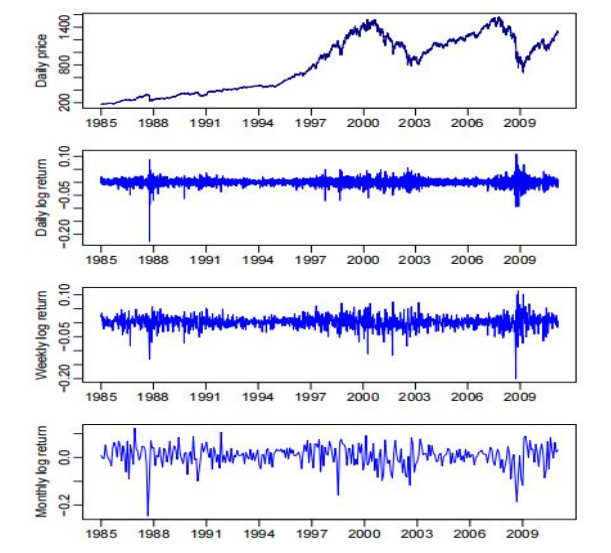

Returns are scale-free, meaning that they do not depend on the numeraire, they depend on how a unit of time is measured. So there are Daily returns, Weekly returns, Monthly returns etc.

The one-period log return is defined as:

rt = logPt−logPt-1= log(Pt/Pt-1) = log(1 + Rt)

The k-period log return is:

rt (k)= rt +rt-1 +...+rt-k+1

In many cases and applications, for the sake of convenience, we often use excess return

rt-r*t , where r*t is a reference rate. We should bare in mind that risk-free rate and market return are two commonly used reference rate.

Tools

Time series

Time series consists of a set of observations measured over time, stationarity is an important concept in it, which means the statistical characteristics of a time series do not change over time.

To be strict stationary, the k-dimensional joint distribution of (X1 ,...,XK) should be the same as that of (Xt+1 ,...,Xt+k), for any positive integer k and any t.

To be covariance stationary, {Xt} should have a finite second moment ,meanwhile, both E(Xt) and Cov(Xt,,Xt+k), for any integer k, do not depend on t.

We can tell:

Asset prices are often not stationary over time, while most return sequences show certain level of stationary.

Volatility clustering(large price changes often occur in clusters)

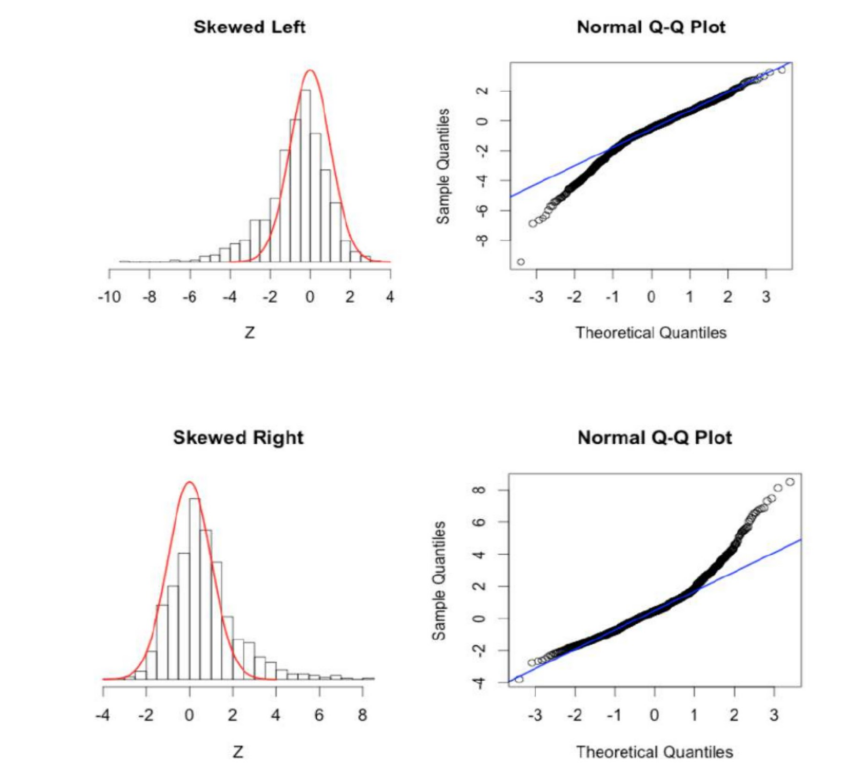

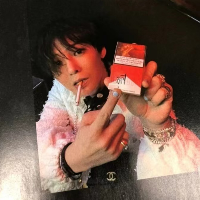

Q-Q Plot