Efficient Market Hypothesis

The EMH

Definition:

A market in which prices always fully reflect available information is called efficient(i.e.,the price is right, and there are no arbitrage opportunities.)

Market forces respond to news quickly and make prices the best available estimates of fundamental values.

Three forms of EMH:

Weak form: security prices reflect all past price information, one can't earn abnormal profits from trading strategies based on past prices alone.

Semi-strong form: security prices reflect all public information(past prices, annual reports, earnings forecast, macroeconomic news, etc),one can't earn abnormal profits from trading strategies based on public information.

Strong-form: security prices reflect all information, public or private to one can't earn abnormal profits from trading strategies based on all information, including public and private.

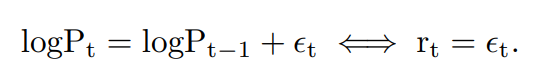

Random Walk Model:

The random walk model has been widely considered a statistical model for movement of log prices.

Remark: A random walk series is not weakly stationary, we call it unit root non-stationary time series(more later)

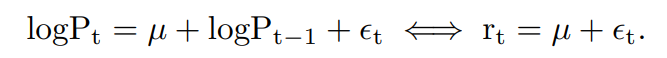

Empirical evidence shows that the log return series of a market index tends to have a small positive mean. This implies that the model for log price is a random walk with drift.

Under the model, price changes are not predictable beyond the mean.

There are 3 assumptions on innovations that implies different degrees of unpredictability, from weak to strong.

White Noise innovations:

Under this assumption,

Under this assumption,

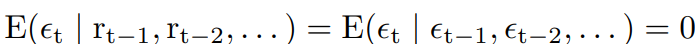

Martingale difference innovations: for any t,

IID innovations: independently and identically distributed,

Relationship among different processes:

IID--->MD--->WN--->Stationarity

White Noise Innovations:

The WN assumption is consistent with the stylized features of returns, and it is implied by EMH(a non-zero correlation between ε and its lagged values leads to an improvement in on the prediction of r)

MD assumption is consistent with the EMH, using the fact that the best forecast is the conditional expectation. The MD assumption is the most appropriate mathematical form of the EMH as it is assures that asset returns cannot be predicted by any rules, but allows certain nonlinear dependence(i.e. asset returns are uncorrelated, but not independent).

According to the efficient market hypothesis, the return of a portfolio is not predictable, but the volatility of a portfolio is predictable.